Research Project Walkthrough

The Age of Alternative Payment Services

Recommendation Two

Traditional banking business models were being challenged to evolve towards an experience that clearly benefited customers due to multiple trends

- Changes in consumer behavior: Customers became more willing to access, view, and perform financial transactions online because it was quick, convenient, and saved them on unnecessary costs. It is consistent with our primary survey results that millennials and GenZ are pursuing Ease of Use, Instant Transfer for digital payment.

- Advances in cloud-based technology: customer-initiated transactions were able to be executed in real-time for processing and clearing, which helped enhance digital capabilities available to users online;

- Power and availability of mobile devices: The evolution of mobile devices, especially app-based smartphones, conveniently brought banking from a desktop to a customer’s pocket.

Additionally, as the first recommendation stated, real-time payment is the global and domestic trend.

In order to follow these trends, better technology is needed in developing related services. Partnership with a fintech company would be a beneficial option.

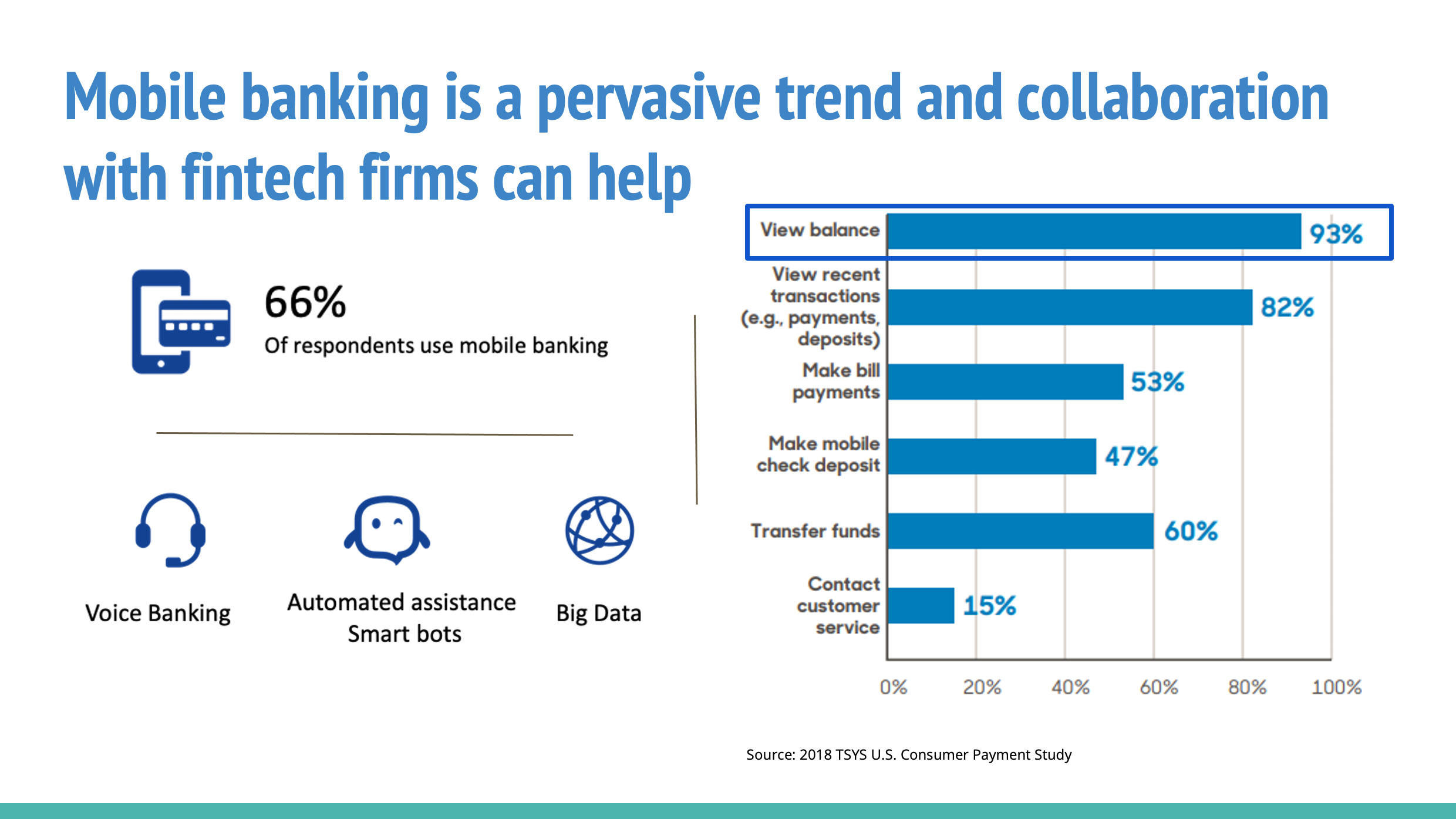

According to the TSYS survey data, 66% of respondents use mobile banking regularly and “view balance” is the most frequent activity they do on a mobile banking app – which is about 93% of the respondents. As the mobile banking service keeps developing, younger customers are expecting more from the bank and the app.

Therefore, the following trends have emerged: voice banking, automated assistance smart bots, and big data related analytics, which all require a lot of technical support.

As most mobile phone users are now familiar with performing voice searches using Google and their cell phones, it is a convenient way to search while on the move. The smart bots allow mobile app users to obtain instant customer assistance via their device and are able to determine the support request quickly and instantaneously, which fits what the younger generation needs – fast & convenient.

Therefore, partnership with fintech can help ESL to follow the upcoming trend in the transformation of mobile app.

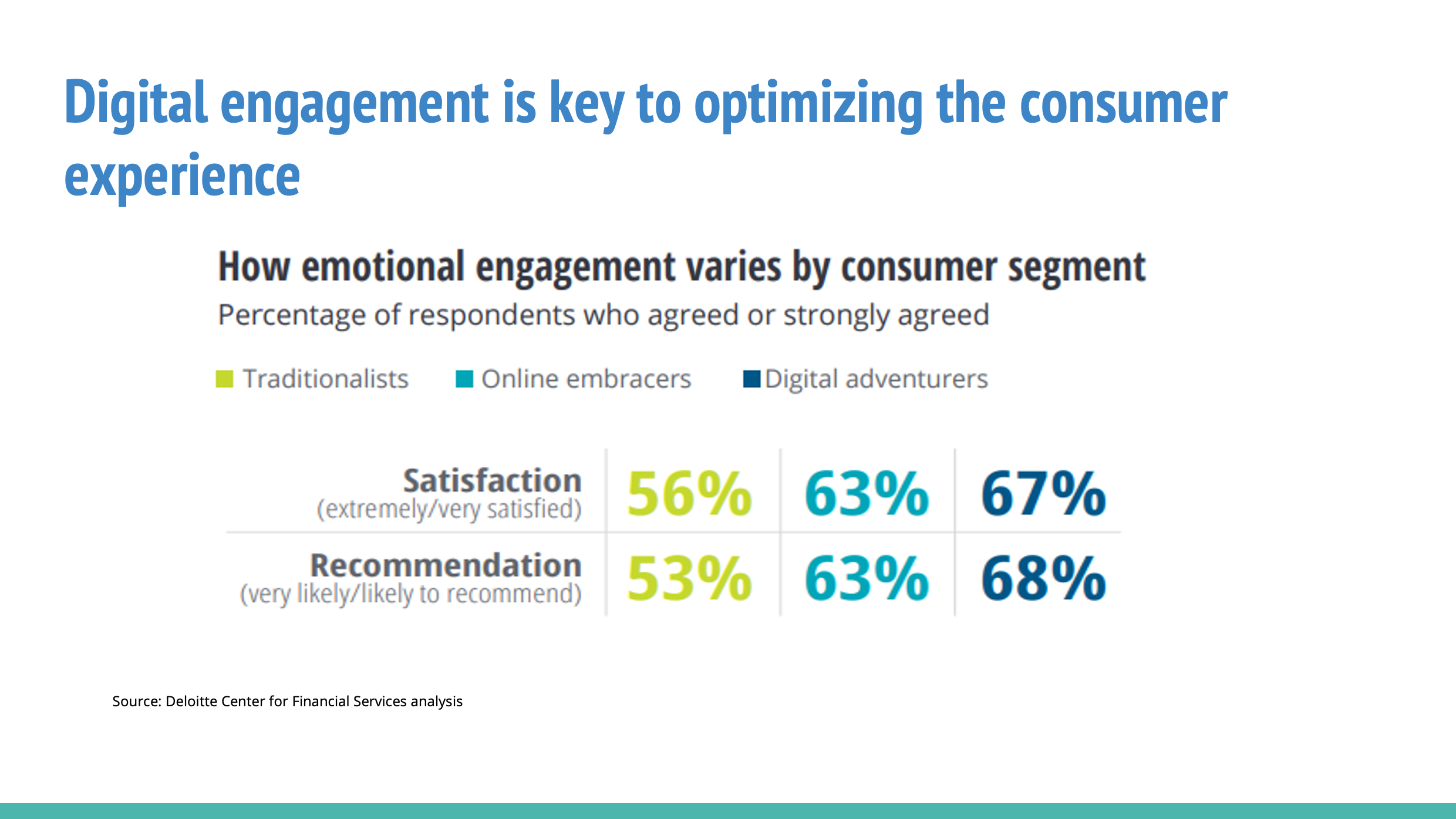

Digital engagement is key to optimizing the consumer experience

Digital engagement is key to optimizing the consumer experience. Here is a comparison of emotional engagement levels for three segments with how customers communicate with banks. Consumers are more engaged through online or digital channels for a bank than through traditional channels, like contacting a branch, which shows the importance of developing integrated online and mobile services. Therefore, a partnership with a fintech would be an ideal option.

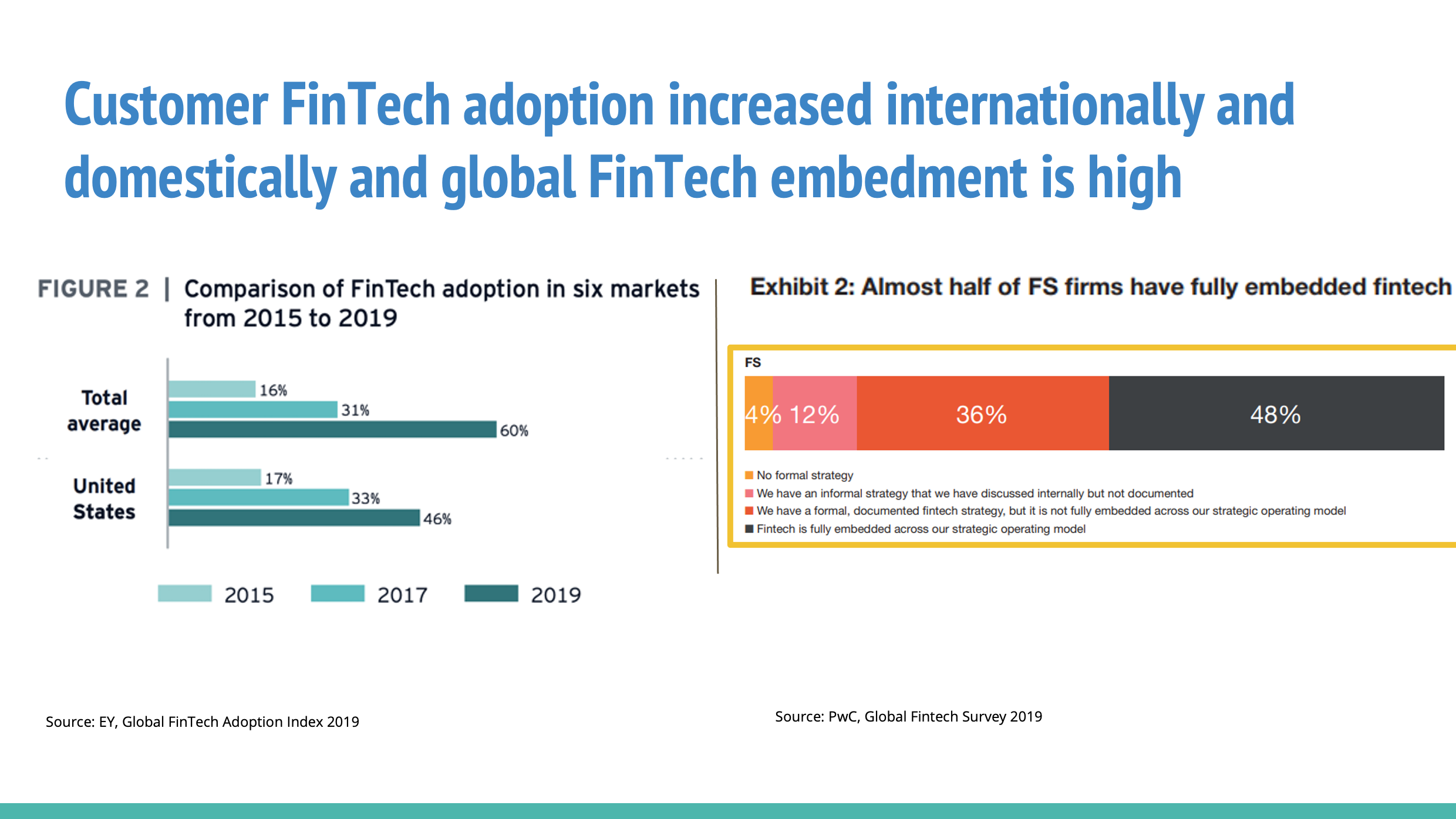

Customer FinTech adoption increased internationally and domestically and global FinTech embedment is high

Over the past few years, the FinTech industry has grown up and grown out. Customer and banking fintech adoption has increased drastically internationally and domestically. The average increase of customer fintech adoption among six international markets between 2015 and 2019 is 44% and the increase of customer fintech adoption for the U.S. market between 2015 and 2019 is about 30%. Customer awareness of fintech rate is pretty high that according to the study from EY, 96% of global consumers are aware of at least one money transfer and payment service and three out of four consumers have used a money transfer and payments FinTech service.

Almost half of the Financial service firms globally have fully embedded fintech fully into their strategic operating model and many have fintech-based products and services. China has a fintech adoption rate of 92% which can be shown by the mass adoption of wechat and alipay and other small financial firms. More than half of banking and capital markets organizations have incorporated emerging technologies into commercial banking and personal loans and an additional 20% plan to do so in the next two years.

Additionally, from a recent survey conducted by Finextra, 81% of banking executives see working with partners as the best path to digital transformation.

See report from American Banker

See report from business insider

Fintech services can help ESL refining the current system, meet customer satisfaction and reduce further cost

Partnership with fintech companies is beneficial for both consumers and the bank itself.

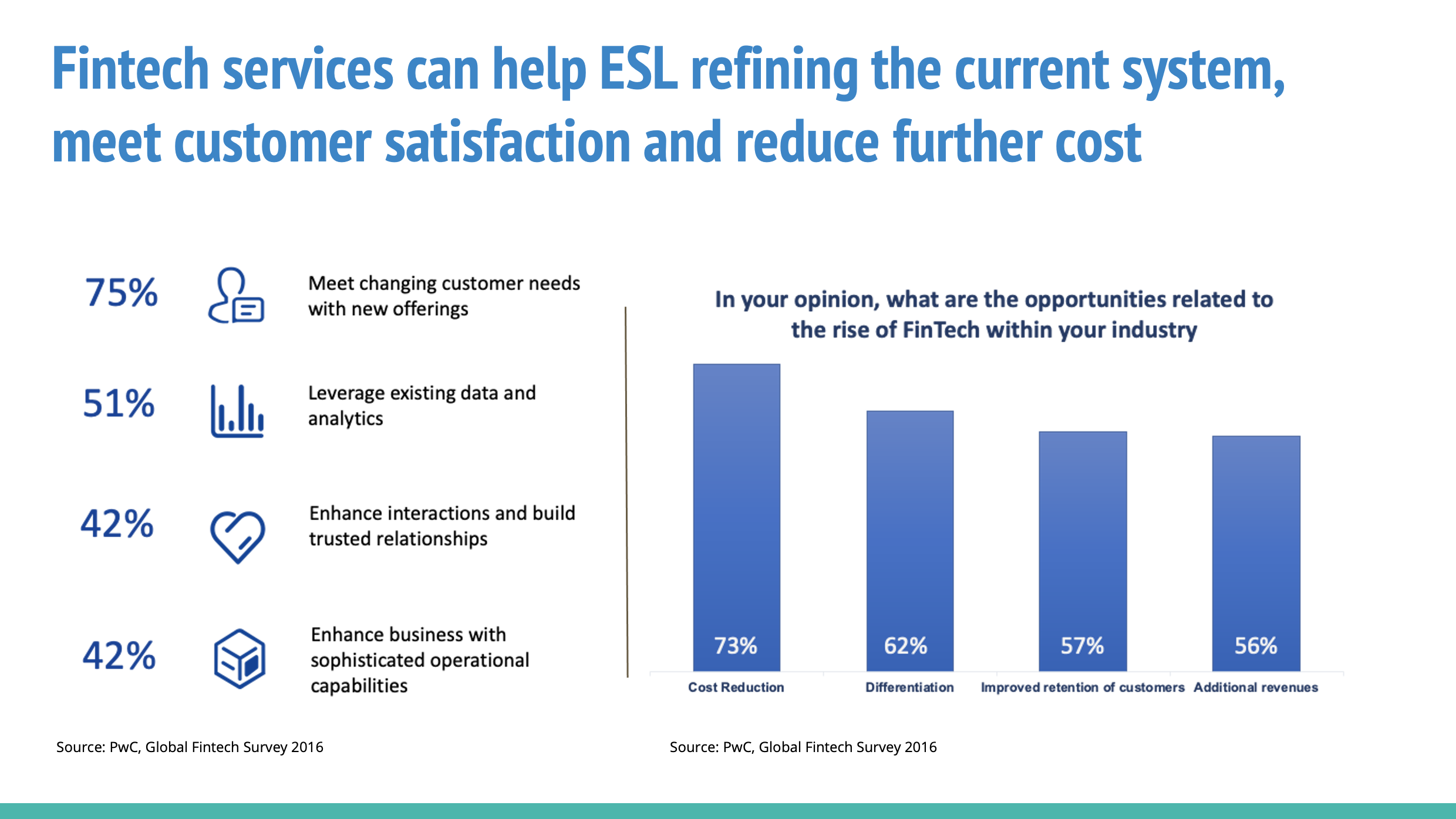

In PwC global fintech survey 2016, 75% of the respondents agreed that fintech would meet the changing customer needs with new offerings, 51% of the respondents agreed that fintech can leverage existing data and analytics which builds more organized data structure pipeline for the bank.42% of respondents agreed that fintech can enhance interactions and build trusted relationships between customers and banks. 42% of respondents agreed that fintech can enhance business with sophisticated operational capabilities.

At the same time, partnerships with fintech companies can also help the bank by increasing the efficiency of incumbent businesses. 73% of the participants believe that fintech would reduce the cost of its own industry, 62% of the participants believe that fintech emergence can help industry differentiations from others. 57% of the talk about all the data. Differentiation and personalization are important in the retention of customers that they expect business to anticipate their needs and act accordingly. They both heavily rely on data-driven approaches.

Overall, the partnership with fintech will be able to meet changing customer needs and increase the profit of the bank.