Research Project Walkthrough

The Age of Alternative Payment Services

Consumer Investigation

Understand Our Customer

Industry Result shows that…

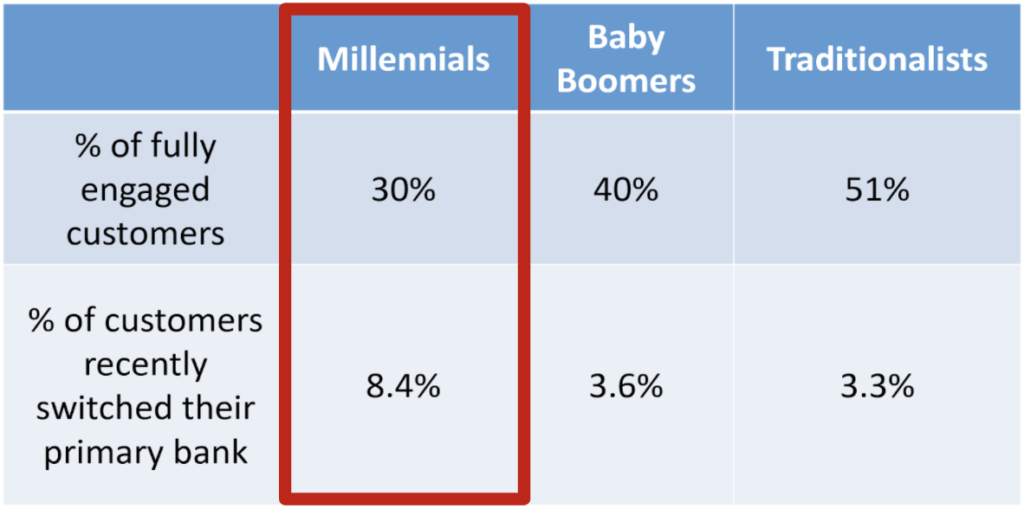

Only 23% of millennials are fully engaged with their primary bank, while 31% are actively disengaged, making millennials the least engaged generation.

The default payment users in our survey confirmed this, as they reported owning an average of 2.8 credit cards, but used only one credit card on average as their default payment option on online marketplace websites.

To win the top-of-digital-wallet position, card issuers will likely have to employ creative strategies to influence consumer behavior. In particular, partnerships between card issuers and retailers will likely increase, and new value exchanges among all transactional parties may have to be forged.

At the end of the day, millennial consumers demand more from payment providers: more creativity, more cashback, more rewards, and a more interesting user experience.

Our Researches Support this Industry Trend

Based on our secondary research, there’s a general trend that the young generation is showing less loyalty among other age groups. Only 30% of millennials are fully engaged customers and as high as 8% are just switching their primary bank, which is more than double of the other age groups.

Based on our primary survey results, we found that the top three attributes that valued by the Millennial and GenZ are “Easy to use”, “instant transfer”, and “Widely adoption”. Combined with that, we came up with three recommendations: “improve the real-time payment”, “join the force of the fintech and central bank”, and “enhance the awareness of ESL current service”.

Implications for ESL:

From our primary survey results, we draw out these four possible factors that lead to the low engagement of Millennial and GenZ. 1) They generally have fewer assets, which means that they seldom try the services other than check balance on the mobile app, 2) They are very likely don’t know the services that ESL is providing, 3) They are an early adopter of the new technology, and 4) there’s not instant transfer service between ESL and other bank accounts.