Research Project Walkthrough

The Age of Alternative Payment Services

Recommendation One

Our first perspective: As the reach of real-time payments expands, so do value-added capabilities. And when combined with other digital and payment trends such as mobile wallets and P2P transfer, the possibilities for improving customer engagement multiply.

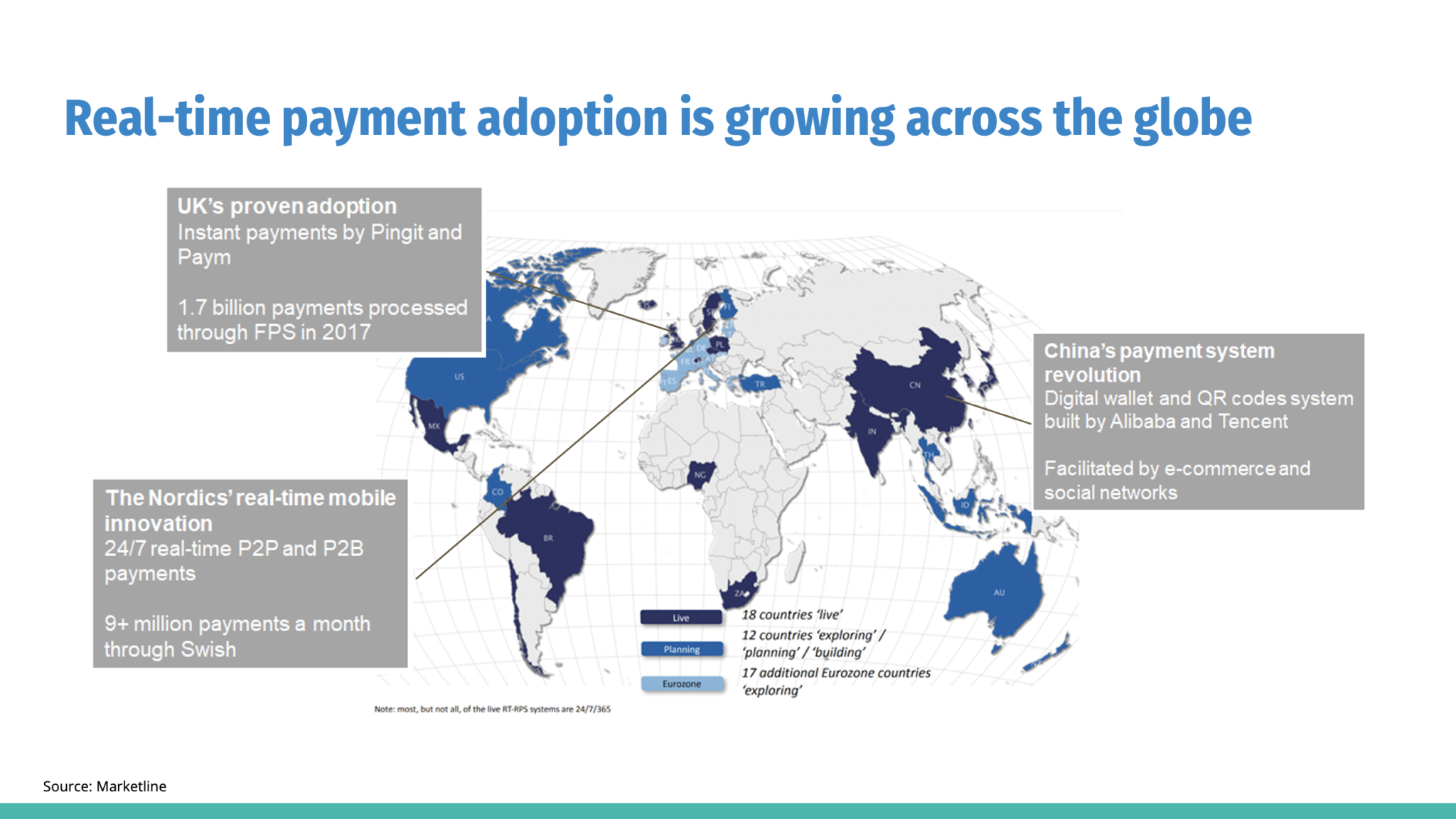

Real-time payment adoption is growing across the globe

Most existing real-time payment systems offer an instant, 24/7, interbank electronic fund transfer service. It can be initiated through one of many channels: smartphones, tablets, digital wallets, and the web. As shown in this map, real-time payment systems are now live in 18 markets globally, which are in dark blue. 12 countries are either planning or building such a system. An additional block of 17 countries that are ‘exploring’ through a pan-Eurozone initiative.

In China, the new payment system revolutionized and leapfrogged the card-based system that remains prevalent in the U.S. The is built on digital wallets and QR codes, which enabled easy, low-cost, instant P2P and C2B transfer. It is run by two big tech firms: Alibaba (China’s version of Amazon) and Tencent (China’s version of Facebook). In fact, this system has already been employed by Walmart – customers can add credit/debit cards to their Walmart app and pay in-store by scanning QR code.

The Faster Payments Service (FPS) in the UK was launched in 2008 and has since become popular in the country’s payments ecosystem. Two mobile payment apps, Pingit and Paym, entered the market in 2012 and 2014 respectively, and they offer a digital, frictionless, and instant payment experience for consumers.

The Nordic region has gained remarkable traction with real-time payment technology. Their banks and non-banks have come together to build a real-time mobile payment solution. Swish, the Swedish mobile instant payments solutions, allow for 24/7 real-time P2P and P2B payments using a mobile phone number. It is now adopted by nearly half of the Swedish population.

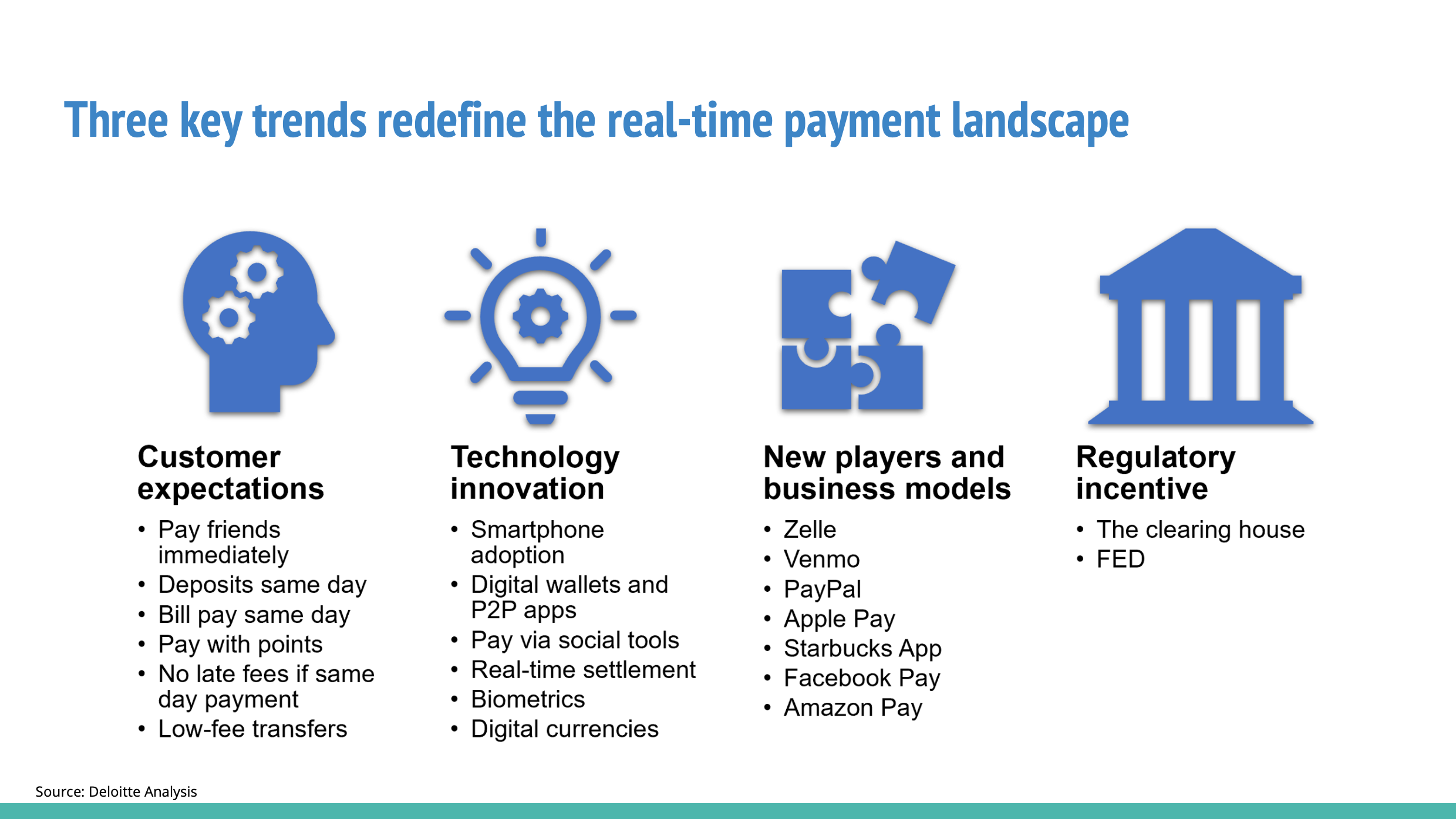

As real-time payment adoption is evolving rapidly, it is important to understand these four trends and what implications they have for ESL

According to a Deloitte report, we can see four key trends that are changing the payment market landscape: rising customer expectation, rapid technology innovation, and entry of non-traditional players with new models. Under Customer expectation, we have Pay friends immediately, Deposits the same day, Bill pays the same day, Pay with points, No late fees, and Low fee transfer.

According to a Deloitte report, we can see four key trends that are changing the payment market landscape: rising customer expectation, rapid technology innovation, and entry of non-traditional players with new models. Under Customer expectation, we have Pay friends immediately, Deposits the same day, Bill pays the same day, Pay with points, No late fees, and Low fee transfer.

We can see that many consumers now expect almost everything to be available in real-time — and this is new in payments. But paying bills or friends should not be more than a few clicks or touches away. The enablement of real-time payments will help banks innovate their existing value proposition to further increase customer engagement.

Under technology innovation, first is that smartphone adoption among millennials and Gen Z has reached over 90% in the U.S., and consumers use them for a multitude of daily transactions, from buying groceries to paying for public transport. Device wallet and domestic person-to-person (P2P) payment providers are popping up on a regular basis. According to an online consumer survey in 2017, more than half of smartphone users used some type of mobile wallet and the adoption rate is skewed to the younger generation; in fact, 60% of digital wallet users are millennials and Gen Z generations. Social platforms, digital currencies and near-field communication (NFC) based payments are all catalysts for this change. Biometrics enabled fast mobile payment using fingerprint or face ID. Overall, rapid technological change is driving rapid change in the industry.

Thirdly, under new players and business models, we again see the significant increase in digital wallet and P2P transfer. This crowded space includes digital giants such as Apple and Google, fintech such as PayPal and TransferWise, and merchants such as Amazon and Starbucks. These start-ups, spin-offs, and partnerships are introducing new options for the payments sector. We will examine their implications for banks in the next slides.

Finally, there’s a regulatory incentive. In 2017, The Clearing House, a consortium of large banks, created its own real-time payments system. But smaller banks and credit unions have resisted signing up, waiting to see if the Fed would offer a comparable service. Recently, the Fed announced that it will develop the FedNow real-time payment (RTP). This now provides a great opportunity for continued bank-led innovation where institutions can look to differentiate offerings to target and serve the unique payment needs of FinTechs, merchants, and technology companies. It is expected to be available in 2023 or 2024 and details are still uncertain. However, given the global momentum and consumer expectation for faster payments, ESL should prepare for and participate in the ever-changing payments landscape.

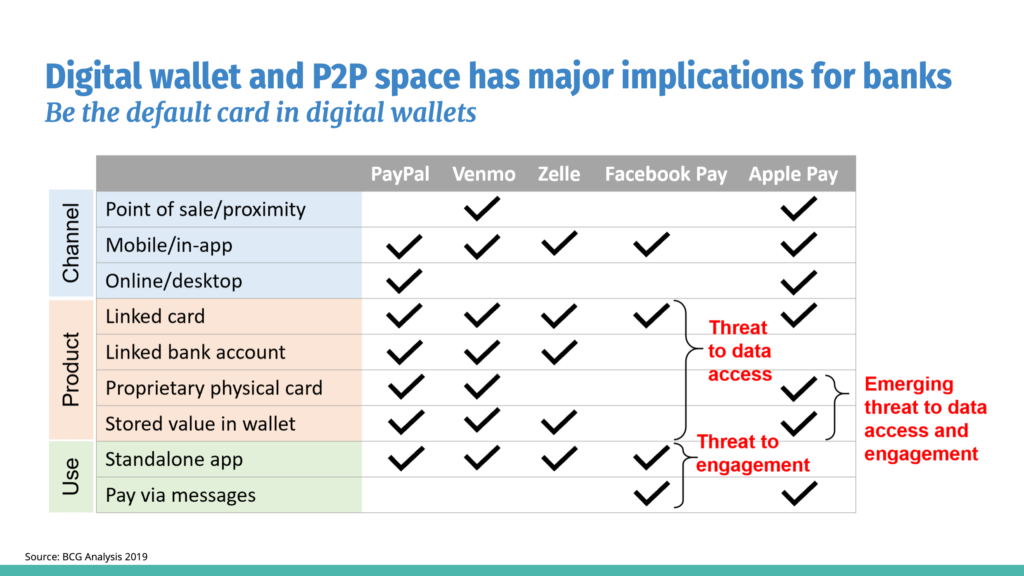

Digital wallet and P2P space has major implications for banks

Be the default card in digital wallets

Two types of digital wallets will be on the front line of the battle for users. Device wallets, from the digital giants, can hold multiple cards and may eventually provide independent value storage (as with Apple Cash) or link directly to the customer’s bank account. Fintechs such as PayPal/Venmo are offering P2P wallets, which completely remove banks from the consumer interface by performing direct account-to-account transfers.

Two types of digital wallets will be on the front line of the battle for users. Device wallets, from the digital giants, can hold multiple cards and may eventually provide independent value storage (as with Apple Cash) or link directly to the customer’s bank account. Fintechs such as PayPal/Venmo are offering P2P wallets, which completely remove banks from the consumer interface by performing direct account-to-account transfers.

Although no dominant wallet type has yet emerged, banks must be concerned. Customers are adopting device wallets fast. The digital giants can exploit their control of these devices to offer a seamless omnichannel experience across point-of-sale, in-app, and browser channels, giving device wallets an inherent advantage over competing for payment types.

P2P wallets are spreading rapidly, too, especially among younger consumers who appreciate their social aspect. To compete, banks’ payment offerings must be intuitive, engaging, and highly relevant to customers’ specific needs.

Device wallets and P2P wallets threaten the primacy of banks in two ways. First, they pose a threat to data by reducing the number of bank transactions, leaving banks with less data on their customers, and less value stored in customer accounts. Second, they pose a threat to engagement by preventing customers from deepening their relationship with the bank. This is especially serious because primary customers rely on a bank for deposits, checking, and other core banking services.

On the bright side, the success of apps like Zelle and Venmo paints a picture that consumers are eager for real-time, ubiquitous, and frictionless payments.

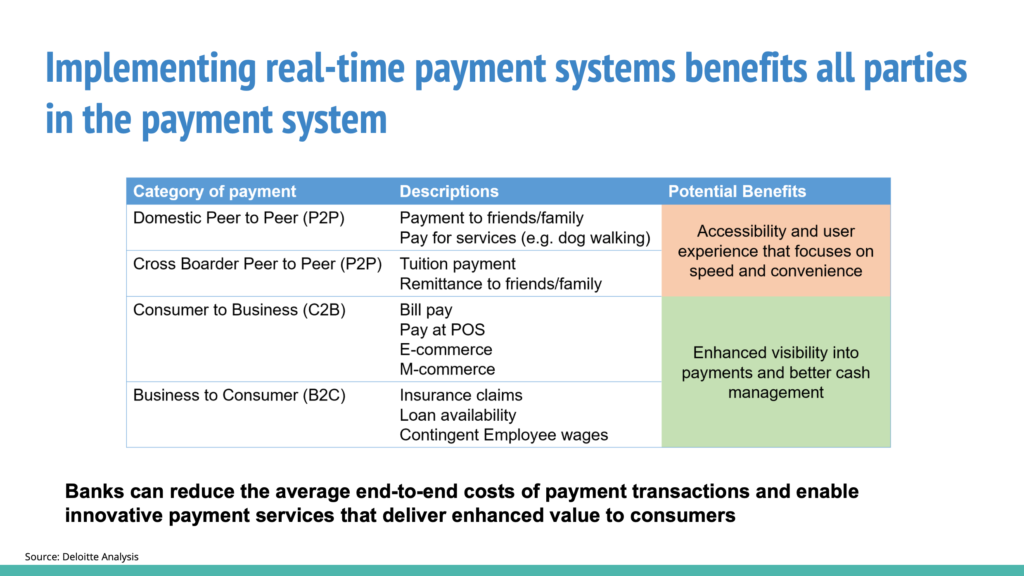

Implementing real-time payment systems benefits all parties in the payment system

Banks can reduce the average end-to-end costs of payment transactions and enable innovative payment services that deliver enhanced value to consumers

Real-time payments are likely to completely affect the way we transact and conduct business. When that time comes, consumers could enjoy the convenience of paying their bills at the last minute without penalties. Businesses could benefit from the increased availability of funds. Financial institutions could be able to provide better services. While challenges remain to reach this utopian future state, we predict that real-time payments will likely generate new consumer behaviors and spending patterns, thus increasing revenue for the payment players who are well-positioned to capitalize on this evolution.

Most RTP payments are currently peer-to-peer (P2P) of small amount transactions. However, RTP technology can be applied across all payment categories: B2B supplier payments; B2C payments such as legal settlements, insurance claims, wages; C2B payments such as hospital bills, utility payments, and point-of-sale purchases; and domestic P2P and cross-border remittances.

This system can benefit financial institutions (FIs), merchants, consumers in all cases by offering enhanced visibility into payments, by enabling better cash management and by helping businesses better manage day-to-day operations by improving liquidity. One example is the Peer to Peer (P2P) space, where there are currently more than twenty applications in the US market, enabling payments on smartphones, using bank accounts or debit cards. We believe this rapid growth of P2P is largely driven by accessibility and an attractive user experience that focuses on speed and convenience for both domestic transfers and cross-border remittances.

These systems are still the exception rather than the rule, but this is expected to change soon. Let’s consider credit cards, initially only available to the rich people, it required more time for banks to gain comfort with a wider user base. ATMs saw slower adoption at first, too, due to costly network requirements. On the contrary, debit cards were adopted at a faster pace because the existing network of acceptance points was in place. Online and mobile banking similarly took off due to the availability of personal computers/access and mobile penetration. In the same way, the basic conditions are in place for the US to see the rapid adoption of real-time.