Research Project Walkthrough

The Age of Alternative Payment Services

Recommendation Three

Our third recommendation is for ESL to promote the high utility features currently offered on the mobile platform. Understanding Millennial and Gen Z consumers, knowing the value created by ESL’s services, and making sure those target consumers are aware of the services and their value to them.

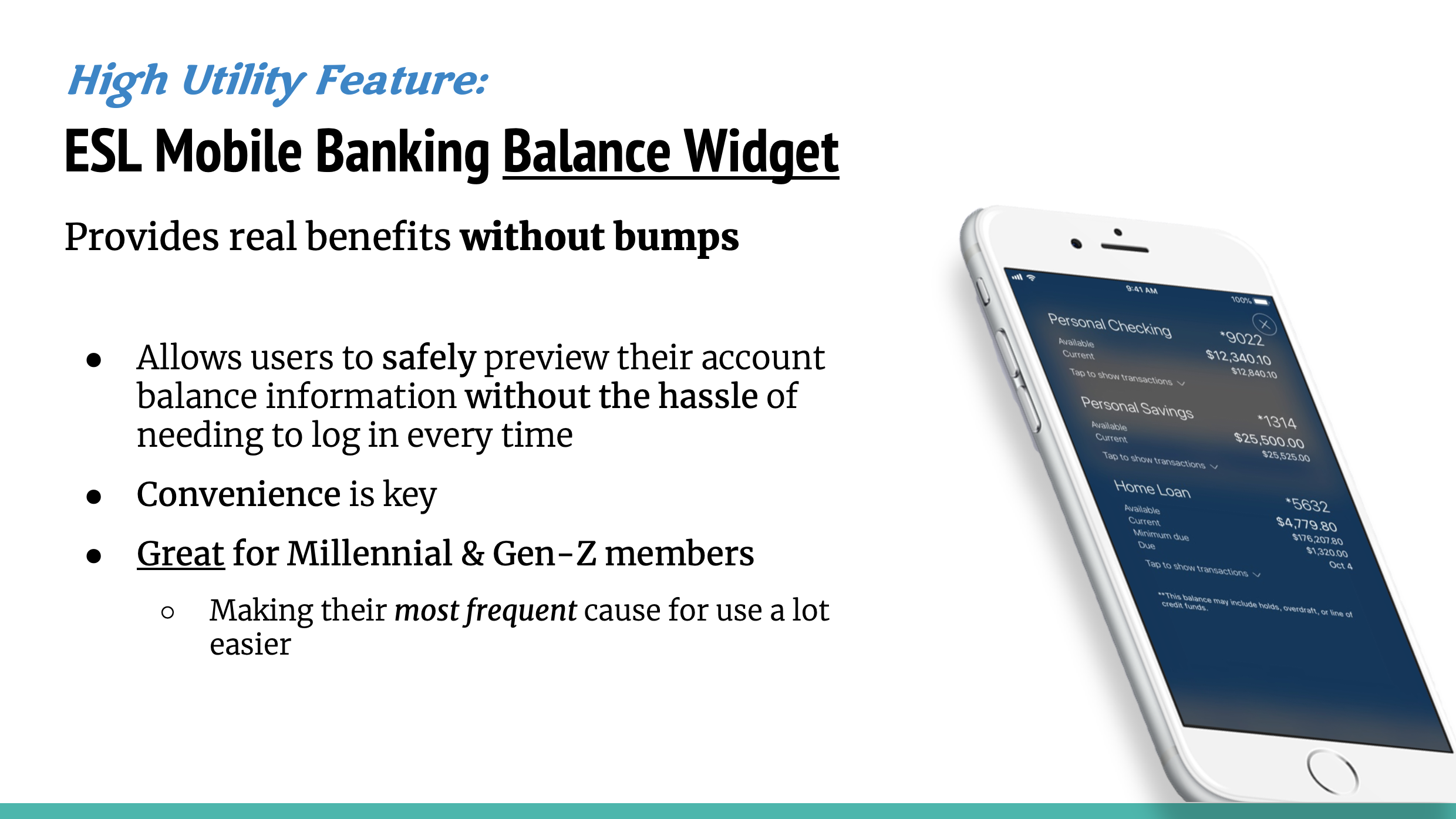

In 2016, ESL ran an ad spot for your personal banking services. It featured the phrase “providing real-time benefits without bumps.” After seeing that, the question for me became: How is ESL currently delivering on that promise to Millennial & Gen Z members? And do those target consumers know about it?

No-Bump User Experience

One feature that fulfills that “no bumps” promise is the Balance Widget tool. It allows users to safely view their account balances within moments of clicking ESL’s Mobile app, no log in required. This delivers real value to members. Especially to younger members, by making their most frequent reason for opening the app more convenient. Which is a huge motivating factor for the target cohorts.

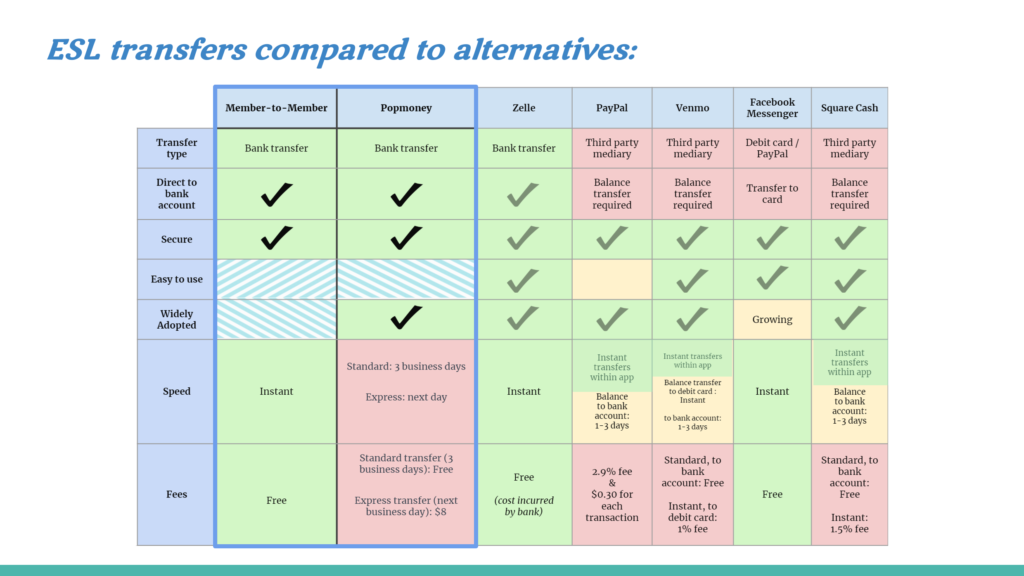

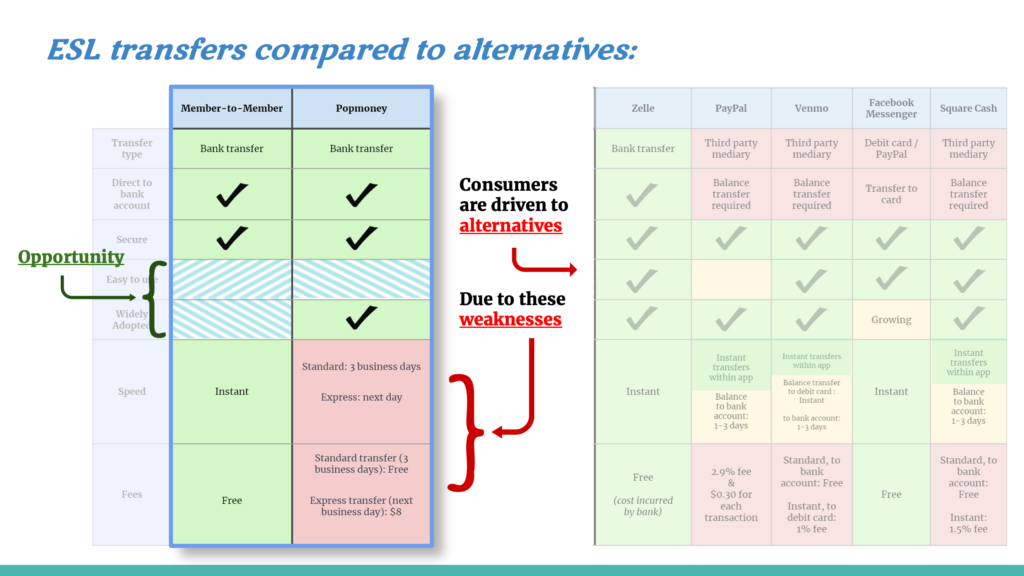

As we saw before, young consumers are typically faster at adopting new technology, which is part of the reason that demographic has led the growth in adoption of alternative payment services over the past few years. It is important to understand why consumers are driven to alternatives, and how ESL’s services stack up to those options. We have a comparison chart here between ESL’s P2P payment transfer services (Member-to-Member and Popmoney) and some of the top players in the domestic P2P payment space. When looking at the top motivating attributes and pain points for Millennials and Gen Z’s, we can begin to better understand consumer choices.

With instant gratification being such an important factor for Millennial and Gen Z consumers, it’s likely that Popmoney wouldn’t even cross the mind of a younger ESL member when making the choice of which P2P payment service to use in any given instance. Especially when the express option comes with an $8 fee. Member-to-Member transfers satisfy a lot of key attributes while avoiding the strongest pain points. This is probably why when comparing solely ESL’s P2P services, last month, 81% of transfers were Member-to-Member, and only 19% were through Popmoney.

How well does the ESL’s service delivers on wide adoption and ease of use?

Satisfying these top attributes gives us confidence that members would find great utility in the Member-to-Member payment service. But based on our primary research, we aren’t as confident about how ESL’s service delivers on wide adoption and ease of use. These areas provide us with an opportunity for growth. And our third recommendation outlines some potential strategies to seize that opportunity.

Looking to position the service and its value in the minds of members

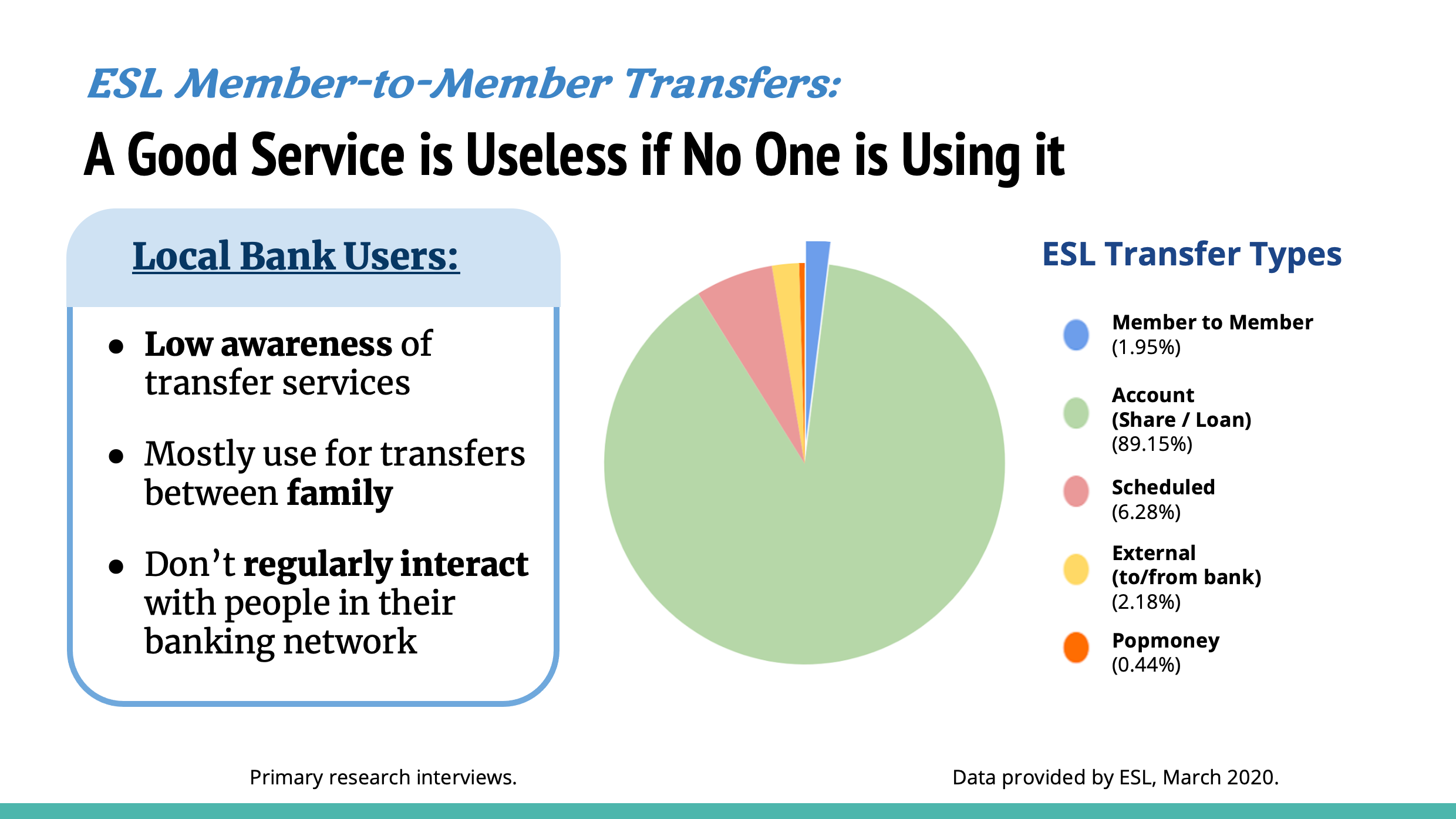

With such a strong service, and such a large network of members across the Rochester Metropolitan Area, why aren’t more members using the Member-to-Member payment service?

Our primary research shows us that Millennial and Gen Z local bank users typically have lower awareness of services offered by their bank, including P2P transfers, and if they are aware of the service, they mostly use it to send money between relatives. Many of our interviewees were living outside of the area of their local bank, so they did not interact with fellow members very often.

But with over 350,000 members, ESL members are interacting with each other every day in social and professional settings. Yet still, when looking at March 2020’s transfer data, less than 2% of all transfers were P2P between members. Less than .5% were through Popmoney, which should be expected due to delays and fees. But since the Member-to-Member service so strongly satisfies the top attributes, a lack of wide adoption can likely be explained by low member awareness.

Imagine a scenario of two friends, both ESL members, regularly using Venmo or Cash App to pay each other when splitting the bill for meals or drinks. This happens when members:

- don’t know about the Member-to-Member payment service

- don’t know that if their friends are members/use the service

This engagement can be captured because ESL’s service between members satisfies all the same motivating attributes as the alternatives, with the added benefit of avoiding any middle-man balance transfers. Here is a concept for a tagline: “as simple as asking, do you use ESL?”